The one thing that I have understood from the past two year is that life is pretty unsure and we have to plan early to keep up with the uncertainty. Because when tough times come, we have to be ready. As a kid, my parents always taught me to spend wisely and save some amount.

Though there were no hard and fast rules of how much to spend and how much to save, yet I can say that my parents did pretty good for themselves and inspired me to follow the same path.

So I can say, for me, budgeting is quite deep rooted. I didn’t know the technical terms or details of different budgeting types until I was an adult, but I always knew the basics like keeping atleast 20% of your totals income for savings and rest for you to use. At least that’s what my dad follows (till today).

Credit – Here

When I grew up & started earning and kind of running my own household, I started to learn more about budgeting and implementing different methods to find the most efficient one for me.

In the process, I learned one of the most important thing which is “to find the balance”. Balance between income and expenditure, balance between wants and needs, balance between patience and impatience.

Here are some of the budgeting methods that I found really effective if you apply them properly.

Credit – Here

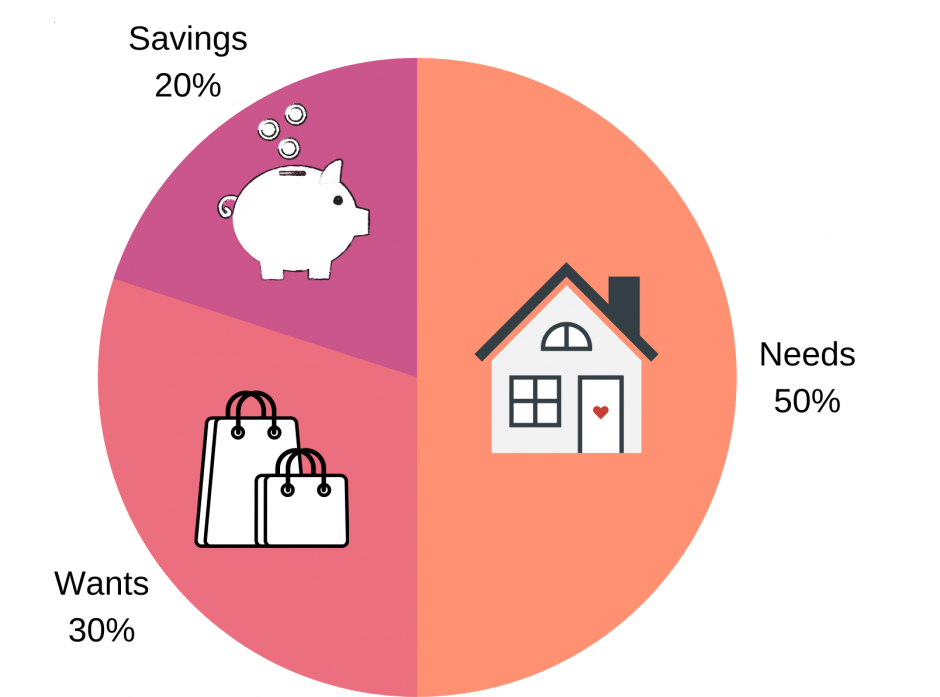

1.) The 50/30/20 method:

This is one of the most basic method of budgeting where you keep 50% of your income to your necessities like rent & bills, 30% to your wants and 20% to your savings. I always used it in backward order. So after keeping 20% of my income asides for savings, I would divide my rest of the money into necessities and wants. That kept my saving quite steady and stable.

2.) The Envelope method:

This method helped me when I was a little low in income but couldn’t curb my wants and needs. I have to give myself a strict limit for each big spending and stick to it no matter what. I just keep the cash in the envelopes and as soon as I ran out of money, it was a no go for me for that particular need. Yes, it was a it harsh but it kept my spending in check.

Broadly, I have always used these methods only and they have worked really good for me so far. But there were times when none of the budgeting methods worked for me and I have to look for loans for my extra and unavoidable expenses. Those were the actual hard times. Believe me, managing your own money is still easy than borrowing others and paying back. And the even the tougher task is to find the loan with so many formalities and requirements. While looking for loans, I came across MoneyMutual which is basically trusted venders in one spot.

It is an online marketplace for simple, quick and secure access to lenders. It is a free resource that provides potential borrower and lenders the ability to come together. I found it quite useful and worth a try if you are looking for any potential loans.

At the end of the day, whether its through budgeting or getting loans, we have to get through it and work hard to do well for ourselves.

Credit – Here